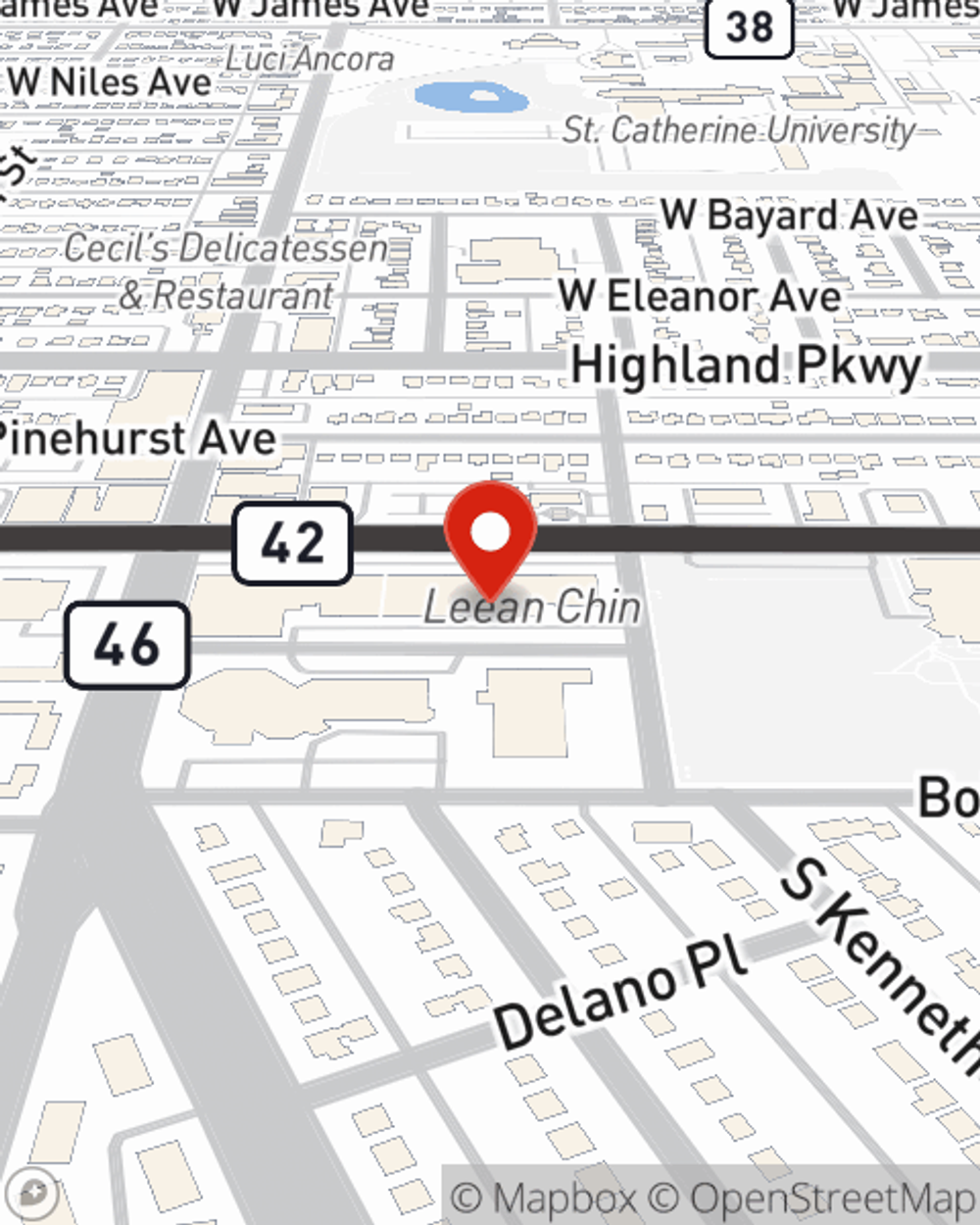

Condo Insurance in and around Saint Paul

Looking for outstanding condo unitowners insurance in Saint Paul?

State Farm can help you with condo insurance

Home Is Where Your Condo Is

Often, your home base is where you are most able to chill out and enjoy family and friends. That's one reason why your condo means so much to you.

Looking for outstanding condo unitowners insurance in Saint Paul?

State Farm can help you with condo insurance

Safeguard Your Greatest Asset

There's truly no place like home. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted name for condo unitowners insurance. Chad Babcock is your knowledgeable State Farm Agent who can present coverage options to see which one fits your individual needs. Chad Babcock can walk you through the whole coverage process, step by step. You can have a straightforward experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your linens, furniture and electronics. You'll want to protect your family keepsakes—like souvenirs and pictures. And don't forget about all you've collected for your hobbies and interests—like tools and videogame systems. Agent Chad Babcock can also let you know about State Farm’s great savings and coverage options. There are savings if you have home security devices or have an automatic sprinkler system, and there are plenty of different coverage options, such as additional business property and even personal articles policy.

Don’t let the unknown about your condo keep you up at night! Contact State Farm Agent Chad Babcock today and discover how you can save with State Farm Condominium Unitowners Insurance.

Have More Questions About Condo Unitowners Insurance?

Call Chad at (651) 714-AUTO or visit our FAQ page.

Simple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.

Chad Babcock

State Farm® Insurance AgentSimple Insights®

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

How to be a good neighbor

How to be a good neighbor

What's OK to share — and what might lead to neighbor disagreements? Read on for ideas to avoid property line disputes, build bonds and maintain community.