Business Insurance in and around Saint Paul

One of the top small business insurance companies in Saint Paul, and beyond.

This small business insurance is not risky

State Farm Understands Small Businesses.

When experiencing the challenges of small business ownership, let State Farm be there for you and help provide quality insurance for your business. Your policy can include options such as errors and omissions liability, a surety or fidelity bond, and business continuity plans.

One of the top small business insurance companies in Saint Paul, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

Why choose State Farm for coverage? Your fellow business owners have rated State Farm as one of the top overall choices for insurance policies by small business owners like you. You can work with State Farm agent Chad Babcock for a policy that safeguards your business. Your coverage can include everything from business continuity plans or worker's compensation for your employees to mobile property insurance or employment practices liability insurance.

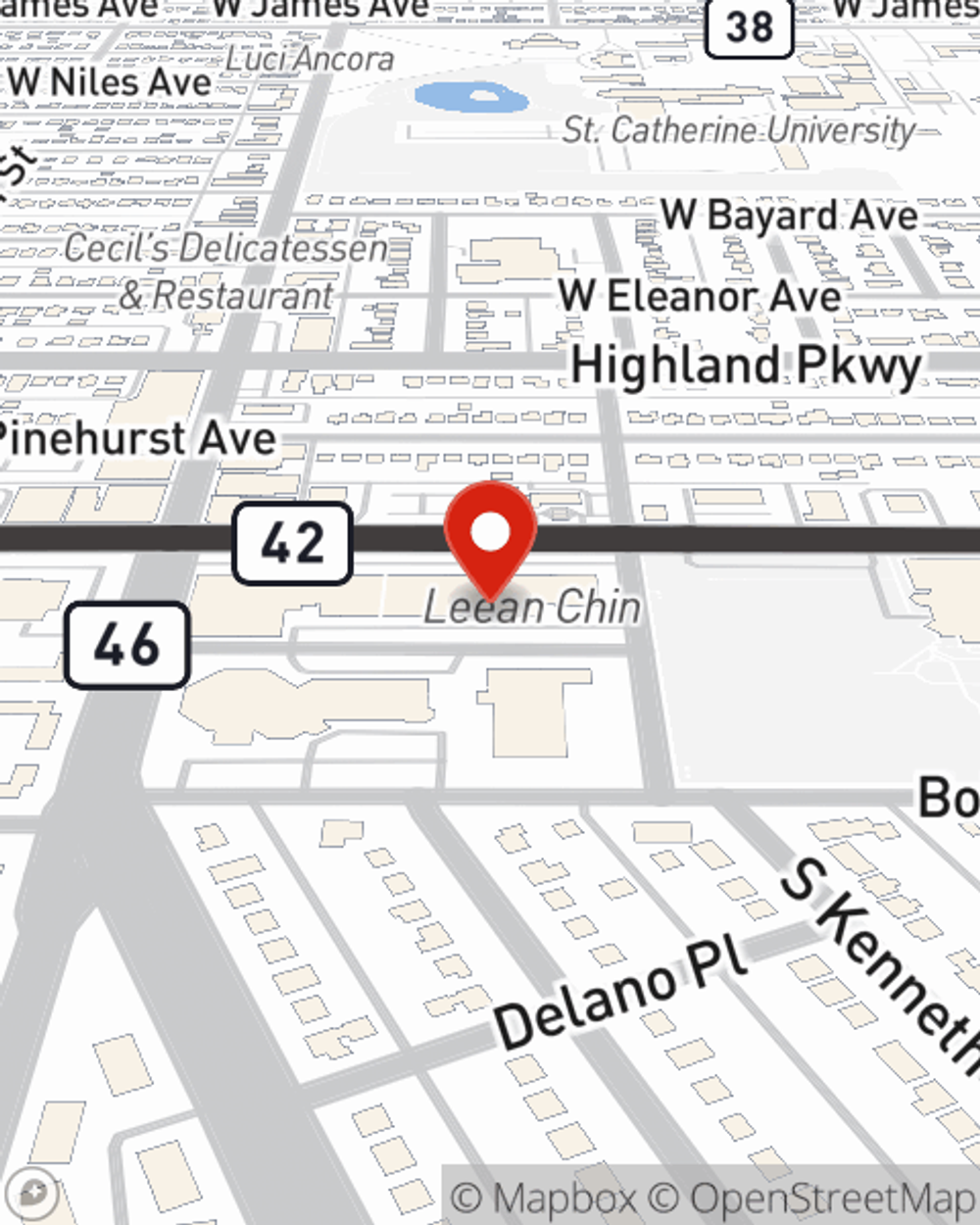

Ready to consider the business insurance options that may be right for you? Reach out agent Chad Babcock's office to get started!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Chad Babcock

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.